PropNex Picks

|June 19,2025$1 Million Resale HDB vs. $1 Million Condo

Share this article:

This is John. He's 35, single, and makes about $15,000 a month.

Recently, he bought a $1 million resale HDB flat in Bishan. His friends are all shocked. "You spent that much on an HDB?" For the same budget, he could've bought a condo. If he had gone for the private market, his journey could possibly be very different.

So, if you're in a similar position and you have $1 million in hand, which one would you choose for yourself? Let's weigh the pros and cons together.

Resale HDB

The good news is that $1 million is enough to get you an express pass to homeownership. Yup, getting a resale means you can skip the long BTO queue!

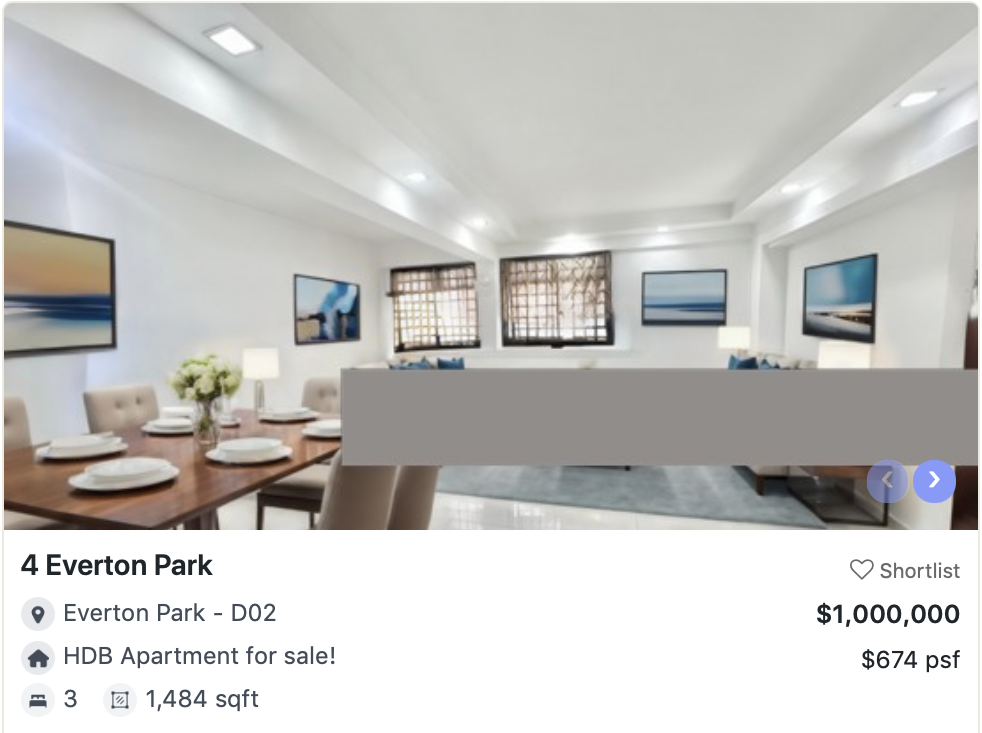

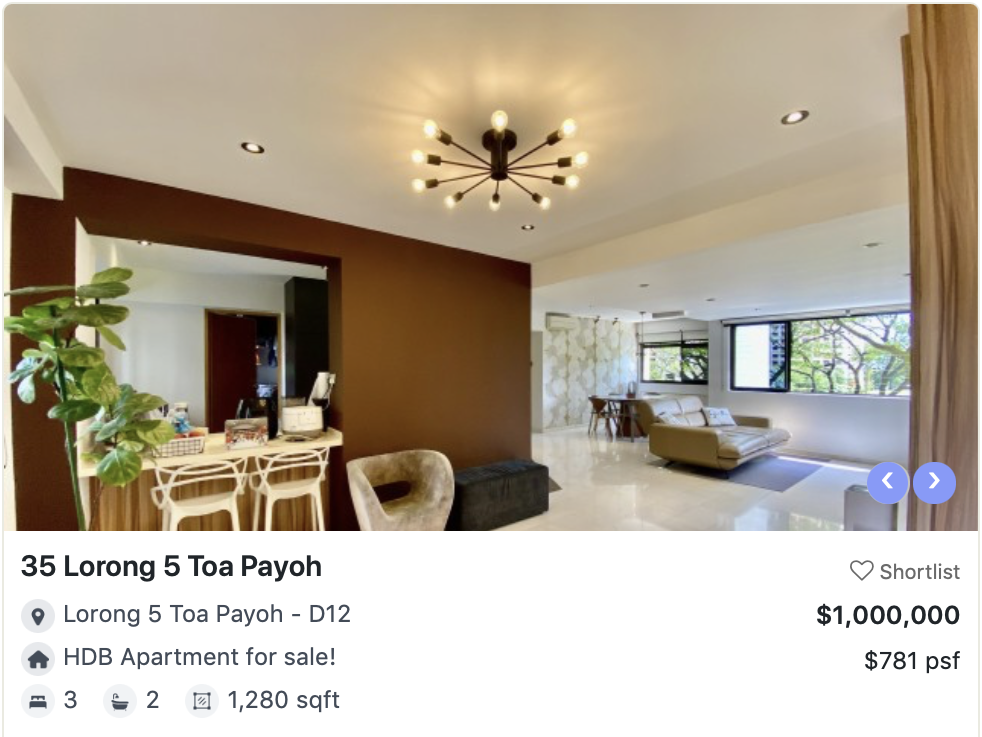

With this budget, you can probably get a 3- to 5-room flat, depending on the location. And it's totally possible to find good options in mature estates like Queenstown, Ang Mo Kio, Bishan or Toa Payoh. Size-wise you're looking at around 1,000-1,500 sq ft. Plenty of space for your family, a home office, or just room to breathe.

Condo

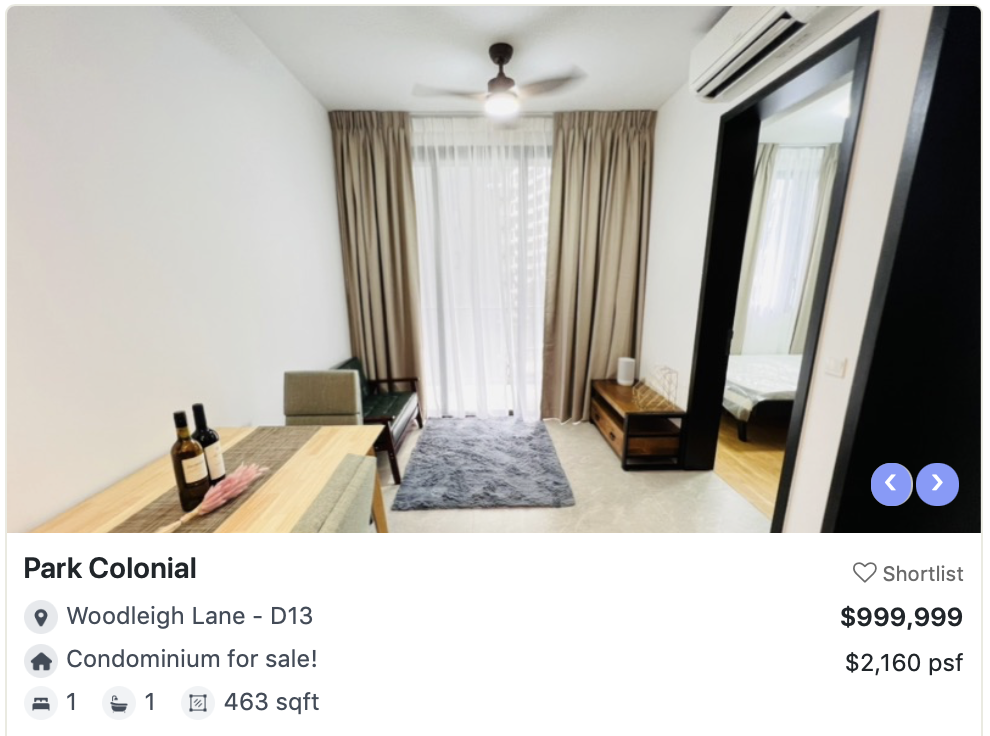

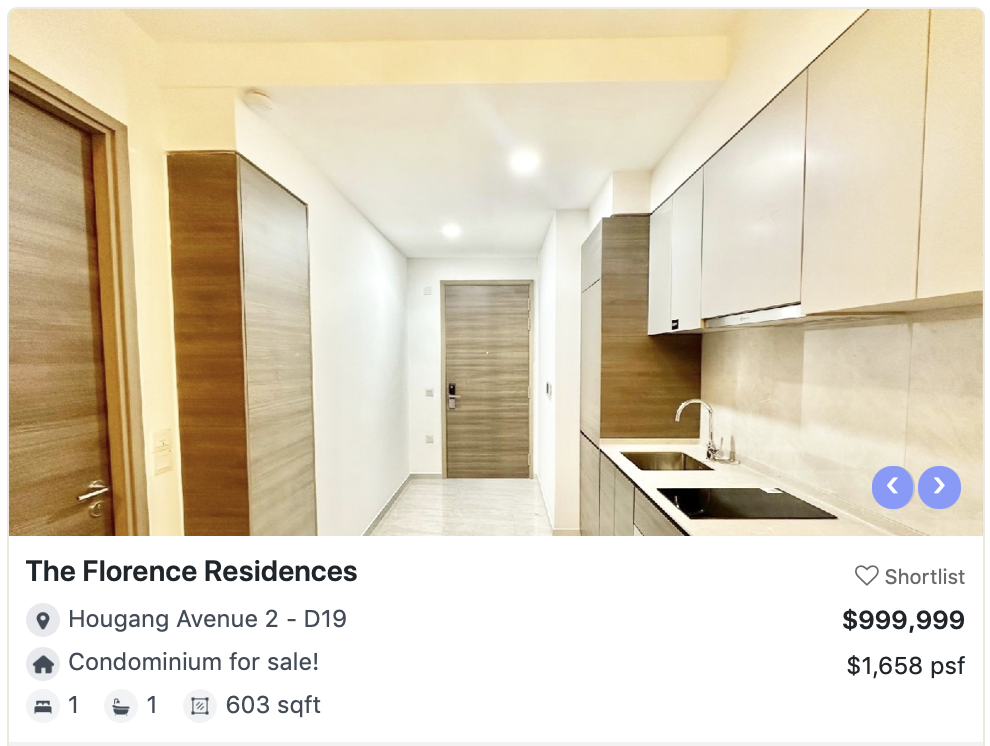

On the other side of the private spectrum, $1 million can get you a 1- or 2-bedroom condo with roughly 450 to 600 sq ft of space. Maybe, just maybe, a 3-bedder if the development is a bit older and in the Outside Central Region (OCR). But honestly, that's a stretch since the price gaps between regions have narrowed in recent years.

The big showdown

Now that we know what $1 million can buy you, let's see who wins across these categories:

Now that you've seen your options, let's talk about financing options. Buying an HDB flat comes with financial perks that condos don't offer. First-time buyers can utilise their CPF to help finance the flat. There are also many housing grants that will help lower the upfront cost.

On top of that, HDB offers housing loans with no lock-in period. The down payment amount is 25%, which is the same as bank loans. The difference is that with an HDB loan, it can be paid fully using your CPF OA. Meanwhile, with a bank loan, 5% must be paid in cash. The interest rate for HDB loan is currently at 2.6%. For banks, it's currently higher and more fluctuative.

Source: cpf.gov.sg

You also need to consider the maintenance fees. With HDB, you pay a Service & Conservancy Charges (S&CC), ranging from around $20 to $115 per month depending on the flat type. So, for a 3- to 5-room flat, it's going to be at least $70 or $50 if you're eligible for reduced rates. But with condos, maintenance fees can total up to $1,000 (maybe even more) per quarter!

Overall, HDB is more affordable in terms of purchase price and maintenance fee. So, if you want to keep your financial commitments low, HDB is the way to go.

Winner: HDB

Condos are generally considered safer than HDB since it's a gated community. Nowadays, you can't even access the lift without a keycard. There's also CCTV and 24/7 security to give you an added peace of mind.

Beyond safety, there's also more privacy. Since access is more tightly controlled, you won't have to worry about getting random flyers shoved under your door or unsolicited knocks from salespeople.

HDB flats, on the other hand, are more open and accessible. Anyone can enter the block, and lifts and corridors are shared among units. While Singapore is generally safe and crime rates are low across the board, it's fair to say that condos offer a stronger sense of personal space and security.

Winner: Condo

Now this is where condos really shine. Condos offer plenty of facilities and amenities that you can conveniently access to within your vicinity right at your neighbourhood. Think swimming pools, gyms, BBQ pits, function rooms, and sometimes even tennis courts or co-working lounges. If you actually use them regularly, the monthly maintenance fees start to feel more justifiable. Sure, HDB has levelled up, but it's not quite at the same level. Not to mention that there's a certain sense of prestige and pride with owning private.

Winner: Condo

While some may appreciate the privacy of condo living, it can come off a little cold because everyone sort of keeps to themselves. You're living near each other, but not necessarily with each other. And if that's what you prefer, that's perfectly fine. But if you find comfort in chatting with your neighbours, HDB is the way to go.

Residents tend to stay longer, and many grow up or grow old in the same estate. So it's common to see lasting friendships between neighbours. There are also more community-driven initiatives that help foster a stronger sense of community. It's nothing fancy, but it's perfect for those who enjoy being part of a kampung-like environment.

Winner: HDB

Yes, condos do command higher rental rates per unit since they look more luxurious and tend to attract higher-paying tenants like expats. But think about it. With a $1 million, you're probably getting a 1- or 2-bedder as I've mentioned before. If you're also living in the unit, then you can only rent out one room, if at all. And yes, even one-bedders are in demand.

But compare that to the 4- or 5-room HDB flat. You live in the master bedroom, and rent out the other two rooms. On average, one common room can go for around $800 to $1,200 a month. The cost of the rental range depends on size, location, and condition. But in general, you're looking at about $1,600 to $3,600 in rental income every month, which is probably more than what you'd get from renting out a single condo bedroom.

The one edge that condos have in terms of rental is that you can rent out the entire unit freely. With HDB, you have to meet the MOP before you can do that. Until then, you, as the owner, have to live there no matter what.

All things considered, HDB still wins. More rooms = more rent. It's a practical choice if you're looking to offset your mortgage or generate a steady passive income.

Winner: HDB

When it comes to capital appreciation, most people assume that private condos do better than HDB. But actually, their resale growth rates have been neck and neck at around 43% over the past decade.

Source: PropNex Investment Suite

So what actually affects their selling potential?

For condos, the buyer pool is broader since they're open to foreigners and investors, not just citizens and PRs like HDB. While this can drive demand, it also makes condos more affected by market trends, global economic factors, and cooling measures. Although Singapore's property market is generally stable, in the short term, condo prices can be a bit more volatile. In contrast, HDB's strict regulations help prevent speculative sale practices and serious price fluctuation thus maintaining market stability.

That said, selling potential isn't just about resale value. It also depends on what your mid- to long-term goals are. If you're looking to eventually upgrade, build wealth through property, or time your exit when the market is ideal, condos offer more flexibility. Unlike HDBs, there's no 5-year MOP, so you're not tied down. You have more freedom to act when the opportunity strikes.

Ultimately, both HDB and condos can be good bets if you buy smart. Location, remaining lease, and market timing all play a bigger role than whether it's public or private. The difference lies in your risk appetite. Condos may offer higher highs and lower lows. HDBs tend to move slower, but steadier.

Winner: It's a tie

Surprisingly, private leasehold properties tend to lose over 30% of their value after hitting the 20-year mark. Meanwhile HDB flats of the same age only see about a 3% drop in resale prices.

This could be because HDB gets more government support like the Selective En bloc Redevelopment Scheme (SERS). Though they aren't guaranteed, they do offer a sense of long-term security that condos don't. Another key factor is buyer's mindset. Private properties are often purchased as investments with hopes of both rental income and capital appreciation. But as the lease shortens, those returns become harder to achieve, and it gets tougher to sell at a good price. HDB flats, on the other hand, are generally bought as homes. Because they're owner-occupied, not investor-driven, the impact of lease decay is far less severe.

Winner: HDB

At the end of the day, it really depends on what you value most and what your long-term goals are.

If you want more space, stronger rental income from multiple rooms, lower monthly costs, and a warm neighbourhood vibe, then a $1 million HDB flat might suit you better.

But if your goal is to eventually upgrade or elevate your net worth through property, then a condo might offer more flexibility. There's no lock-in period, so you have the freedom to sell and upgrade when the market is ideal. Plus, you get more privacy, prestige, and access to a pool and gym. Yes, you'll pay more in maintenance and give up some space, but you'll have better security and amenities.

Both options have seen healthy appreciation over the past decade, and both come with trade-offs. So the "better" choice depends on which one fits your life better.

Curious to learn more? That clip you saw earlier was from the Property Wealth System Masterclass. If you liked it, feel free to join us at the next one. It's a good way to get grounded insights before making your next move.